November Hurricane Could Shake Stock Market and Florida’s Economy: Here’s What to Expect and…

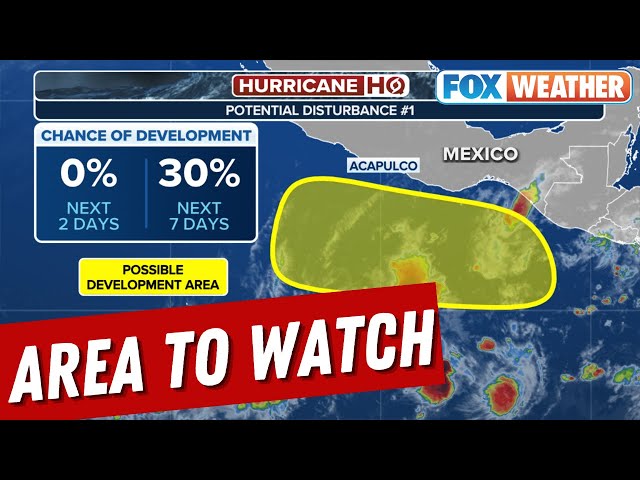

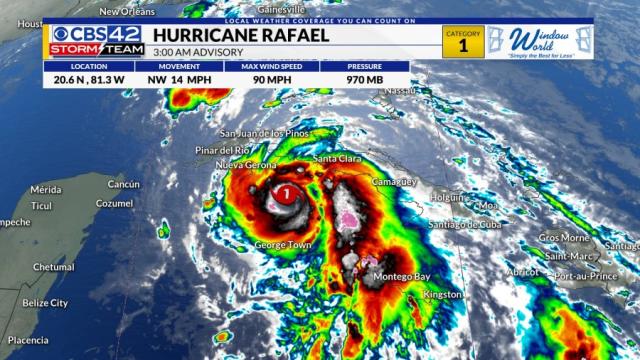

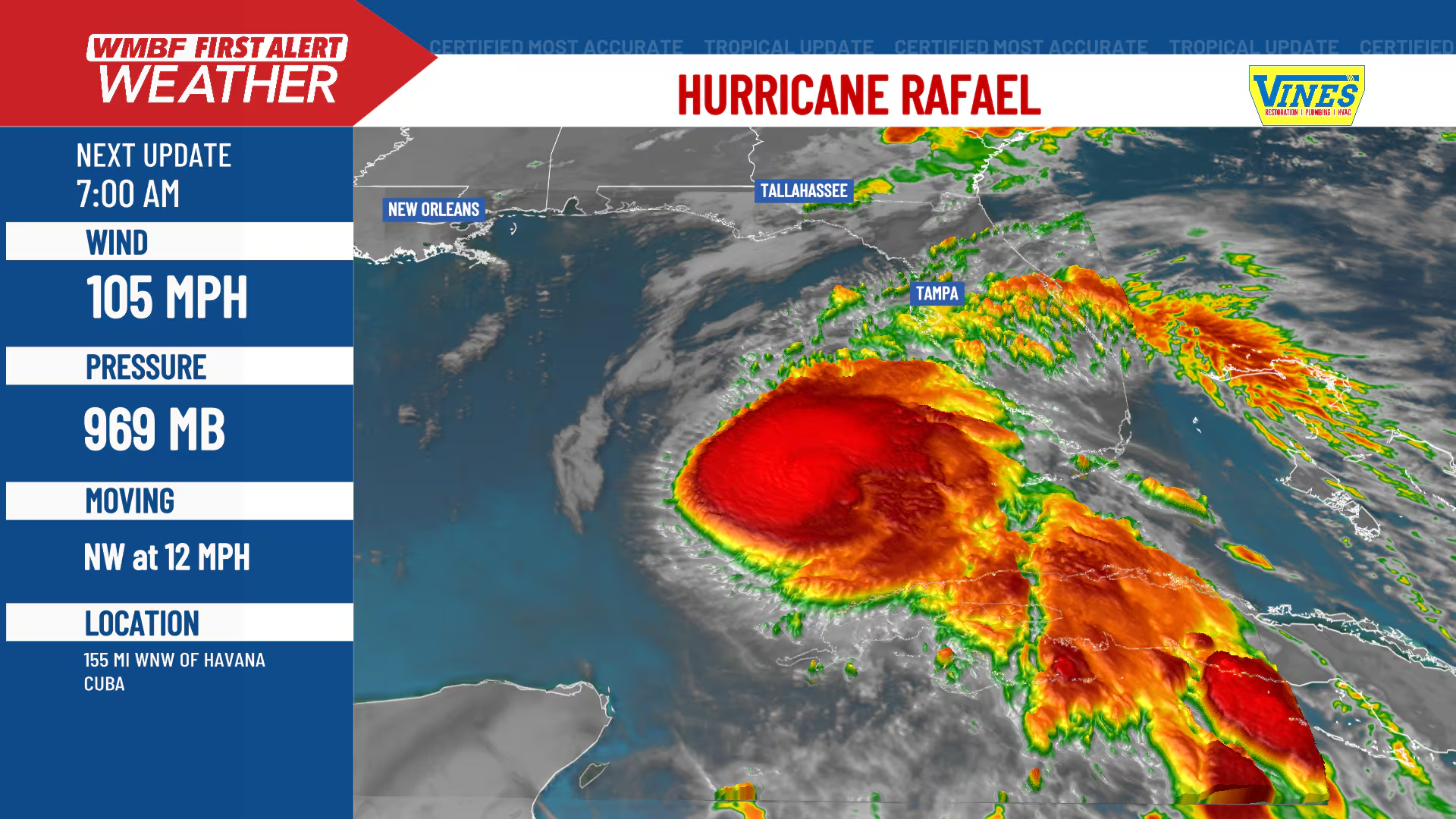

As we head into the tail end of hurricane season, there’s growing concern that a powerful storm could make landfall in Florida this November. Hurricanes are a natural threat to the Sunshine State, but their effects can extend far beyond the coastlines, reaching deep into both the stock market and the broader economy.

In this blog post, we explore how a hurricane hitting Florida could have a significant ripple effect on the U.S. economy, particularly the stock market, and what residents and investors should be prepared for.

The Economic Impact of a November Hurricane

When a hurricane strikes Florida, the effects can be devastating, particularly when the storm hits densely populated areas. Beyond the immediate destruction to homes, businesses, and infrastructure, the storm can also disrupt entire industries, including tourism, agriculture, and real estate. Let’s take a closer look at how this could shake up the broader economy:

1. Disruption to Key Industries

Florida’s economy is highly reliant on tourism, agriculture, and construction, all of which can be significantly impacted by a hurricane. Major tourist destinations like Miami, Orlando, and the Keys may experience a temporary or long-term drop in visitors due to storm damage, evacuations, and lingering recovery efforts.

Florida is also one of the nation’s top agricultural producers, with crops like citrus, sugarcane, and tomatoes heavily impacted by high winds and flooding. Agricultural losses can be steep, and it often takes time for supply chains to recover.

2. Insurance and Real Estate: A Double-Edged Sword

One of the industries most immediately affected by a hurricane is the insurance sector. After a storm, claims can skyrocket, leading to major payouts for property damage, flood recovery, and business interruptions. This can lead to volatility in the stock prices of major insurance companies, both for better and for worse, depending on the storm’s severity. On the flip side, Florida’s real estate market, particularly in coastal and vacation areas, can suffer a blow due to property damage, which may lead to a slowdown in construction, sales, and investments.